Navigating finances during a recession

[edit] Introduction

In times of economic downturn, managing your money wisely becomes paramount to weathering the storm. This comprehensive guide aims to equip you with the knowledge and strategies necessary to navigate your finances effectively during a recession. From budgeting and saving to investing and debt management, we'll cover all aspects to ensure your financial well-being remains intact, even in challenging times.

[edit] Understanding Recessions

[edit] What is a Recession?

A recession is a significant decline in economic activity spread across the economy, typically characterised by a decrease in GDP, employment, and trade lasting for a prolonged period.

[edit] Recognising Economic Indicators

Understanding key economic indicators such as GDP, unemployment rates, and consumer spending can provide insights into the onset and severity of a recession.

[edit] Historical Context

Exploring past recessions can offer valuable lessons and insights into how to navigate the current economic landscape.

[edit] Financial Preparedness

[edit] Emergency Fund Essentials

Building and maintaining an adequate emergency fund is crucial during a recession to cover unexpected expenses and mitigate financial stress.

Establishing clear savings goals tailored to your financial situation ensures you have a safety net in place when times get tough.

[edit] Debt Management Strategies

Effectively managing debt obligations is essential to avoid falling into a deeper financial hole during a recession.

Prioritising Debt Repayment

Identifying high-interest debt and prioritising repayment can help alleviate financial burdens and improve long-term financial stability.

[edit] Budgeting Techniques

[edit] Creating a Lean Budget

During a recession, adopting a lean budgeting approach involves cutting unnecessary expenses and prioritising essential needs.

[edit] Tracking Expenses

Utilising budgeting tools and apps to track expenses enables you to identify areas where you can trim costs and optimise spending.

[edit] Investment Strategies

[edit] Defensive Investing

Shifting towards defensive investment strategies, such as diversification and asset allocation, can help safeguard your portfolio during economic downturns.

[edit] Long-Term Perspective

Maintaining a long-term investment perspective and avoiding knee-jerk reactions to market volatility is key to preserving wealth during a recession.

[edit] Income Generation

[edit] Exploring Additional Income Streams

Diversifying your sources of income through side hustles or freelance work can provide a financial cushion during tough economic times.

[edit] Upskilling and Education

Investing in skills development and education can enhance your employability and open up new income opportunities.

[edit] Real Estate Considerations

[edit]

Understanding the dynamics of the real estate market during a recession can help homeowners make informed decisions regarding buying, selling, or refinancing property.

[edit] Mortgage Relief Options

Exploring mortgage relief programs and refinancing options can provide much-needed relief for homeowners facing financial hardship.

[edit] Retirement Planning

[edit] Protecting Retirement Savings

During a recession, it's essential to safeguard your retirement savings by reassessing investment strategies and adjusting contributions as needed.

[edit] Exploring Retirement Account Options

Maximising contributions to tax-advantaged retirement accounts and exploring employer-sponsored retirement plans can help bolster your retirement nest egg.

[edit] Crisis Management

[edit] Seeking Professional Guidance

In times of financial crisis, seeking advice from financial professionals, such as certified financial planners or advisors, can provide clarity and direction.

[edit] Community Support Resources

Exploring community support resources and government assistance programs can offer temporary relief for individuals facing financial hardship.

[edit] Frequently Asked Questions

[edit] Is it wise to invest during a recession?

Investing during a recession can present unique opportunities, but it's essential to approach it with caution and focus on long-term value rather than short-term gains.

[edit] How can I protect my investments during a recession?

Diversification, defensive investing strategies, and maintaining a long-term perspective are key to protecting investments during a recession.

[edit] Should I prioritise saving or paying off debt during a recession?

Balancing saving and debt repayment depends on individual circumstances, but establishing an emergency fund should take precedence to weather financial storms.

[edit] What government assistance programs are available during a recession?

Government assistance programs such as unemployment benefits, stimulus packages, and mortgage relief programs may provide temporary relief for individuals and businesses impacted by a recession.

[edit] How can I make my money work for me during a recession?

Exploring alternative investment opportunities, focusing on essential expenses, and maximising savings through high-yield accounts can help make your money work harder during a recession.

[edit] What steps can I take to prepare for a potential recession?

Building an emergency fund, reducing debt, diversifying income streams, and staying informed about economic trends are essential steps to prepare for a recession.

[edit] Conclusion

Successfully managing your finances during a recession requires a proactive approach, disciplined financial habits, and a willingness to adapt to changing economic conditions. By implementing the strategies outlined in this guide and staying focused on long-term financial goals, you can navigate through uncertain times with confidence and emerge stronger on the other side.

Featured articles and news

Twas the site before Christmas...

A rhyme for the industry and a thankyou to our supporters.

Plumbing and heating systems in schools

New apprentice pay rates coming into effect in the new year

Addressing the impact of recent national minimum wage changes.

EBSSA support for the new industry competence structure

The Engineering and Building Services Skills Authority, in working group 2.

Notes from BSRIA Sustainable Futures briefing

From carbon down to the all important customer: Redefining Retrofit for Net Zero Living.

Principal Designer: A New Opportunity for Architects

ACA launches a Principal Designer Register for architects.

A new government plan for housing and nature recovery

Exploring a new housing and infrastructure nature recovery framework.

Leveraging technology to enhance prospects for students

A case study on the significance of the Autodesk Revit certification.

Fundamental Review of Building Regulations Guidance

Announced during commons debate on the Grenfell Inquiry Phase 2 report.

CIAT responds to the updated National Planning Policy Framework

With key changes in the revised NPPF outlined.

Councils and communities highlighted for delivery of common-sense housing in planning overhaul

As government follows up with mandatory housing targets.

CIOB photographic competition final images revealed

Art of Building produces stunning images for another year.

HSE prosecutes company for putting workers at risk

Roofing company fined and its director sentenced.

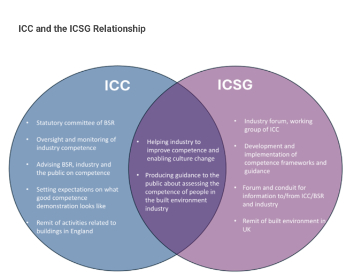

Strategic restructure to transform industry competence

EBSSA becomes part of a new industry competence structure.

Major overhaul of planning committees proposed by government

Planning decisions set to be fast-tracked to tackle the housing crisis.

Industry Competence Steering Group restructure

ICSG transitions to the Industry Competence Committee (ICC) under the Building Safety Regulator (BSR).

Principal Contractor Competency Certification Scheme

CIOB PCCCS competence framework for Principal Contractors.

The CIAT Principal Designer register

Issues explained via a series of FAQs.